Top 3 Things You’ll Learn

- The link between COVID-19 and diabetes

- Multiple chronic conditions grow healthcare costs

- Are we facing a ticking time bomb of chronic conditions

“Can COVID-19 Cause Diabetes?”

“COVID-19 and the potential link to diabetes”

“New type 2 diabetes diagnoses in youth climbed 77% amid COVID-19”

These are just a few recent headlines scaring benefits advisors who’ve seen the growing impact of both diabetes and COVID-19 on plan sponsors in recent years. People are asking if COVID and diabetes are linked – and that’s because researchers and medical professionals are seeing an uptick in diabetes. When we look at our own data, we see the same trend.

The complex relationship between COVID and diabetes

A complex group of factors tie COVID-19 and diabetes together, and the pandemic has exacerbated factors that raise the likelihood of developing metabolic syndrome and diabetes. It can leave behind side effects like asthma, high blood pressure, and cholesterol issues, and the lockdowns led to a change in our daily activities and delayed our doctor’s appointments. This is not limited to the adult population, either.

Researchers for Johns Hopkins Children’s Center found a 77% increase in the average number of new type 2 diabetes diagnoses for children in the first year of the pandemic.2 They say that the cancellation of regular in-person activities such as youth sports and play dates paired with an increase of time with TV and video games may have contributed to the growth.

Often with a change of activities, the result is a general lack of physical activity and poor eating habits for both youth and adults. Both circumstances can lead to weight gain and obesity development. Obesity can further lead to insulin resistance, progress to an early diagnosis of prediabetes and eventually type 2 diabetes.

Finally, on top of the pattern of increased diagnoses for diabetes, the risk of deep vein thrombosis nearly doubled for people with COVID-19 in a recent study from the American Heart Association. They found that blood clot-related issues such as heart attack and stroke were more likely for up to 49 weeks after diagnosis.3 Therefore, the ramifications of the pandemic could either directly or indirectly lead to worse health outcomes.

The unexpected cost of new or worsening diagnosis

Since the inception of COVID in the first quarter of 2020, we have seen a significant uptick in the total cost and utilization of diabetes products, from insulin to diabetic supplies.1 Not only are there newly diagnosed diabetic patients, but we also see existing patients with increased non-insulin antidiabetic utilization, specifically branded medications.

Additional medications like Ozempic and Jardiance are being added to some diabetic members’ regimens on top of drugs like Januvia and metformin extended release (the branded combination is called Janumet XR) to increase the intensity of existing prescription regimens.1 Another factor driving cost increases for these medications is an increase in the Average Wholesale Prices of medications like Janumet XR, which had a 16% increase in AWP from ’19 through ’22.

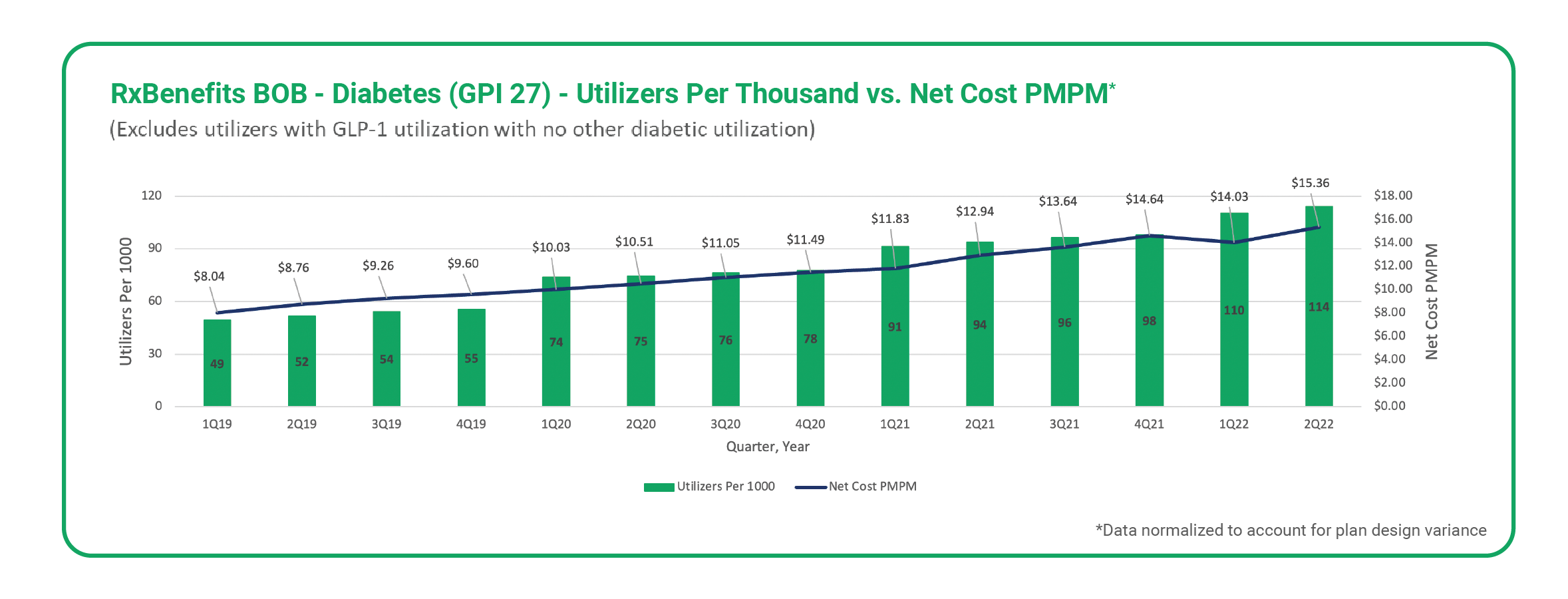

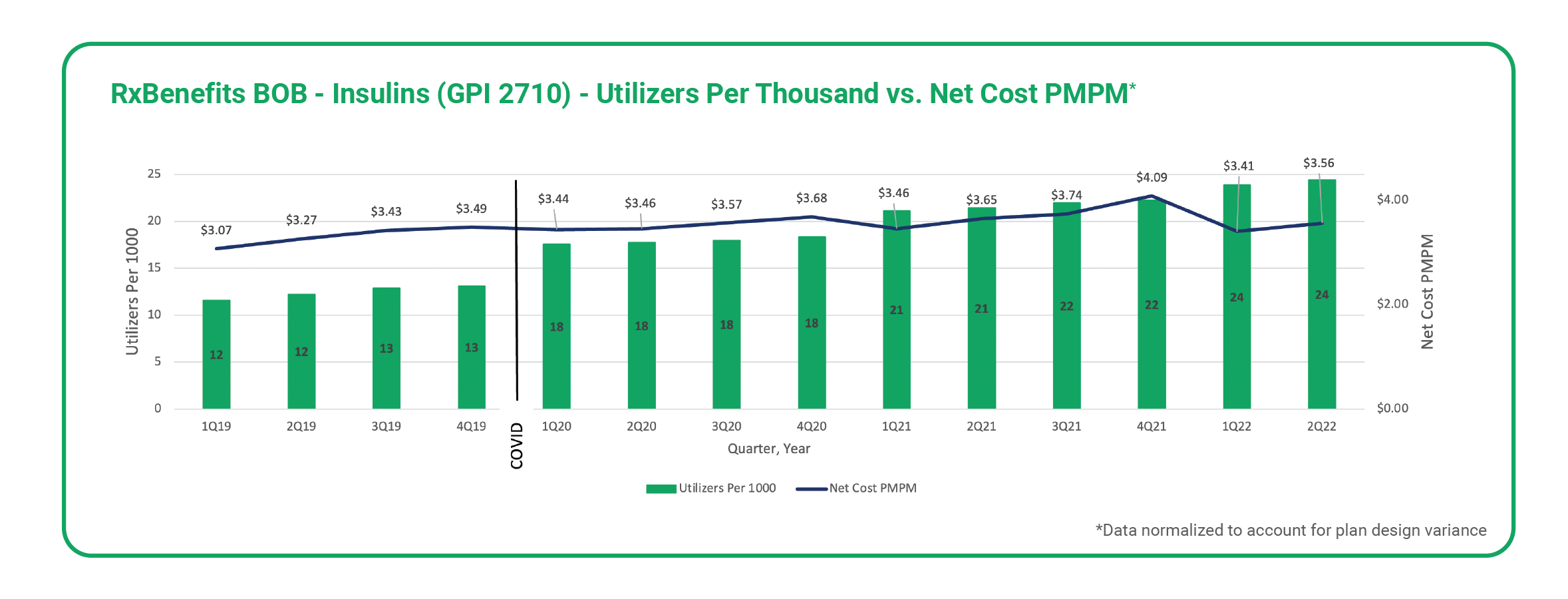

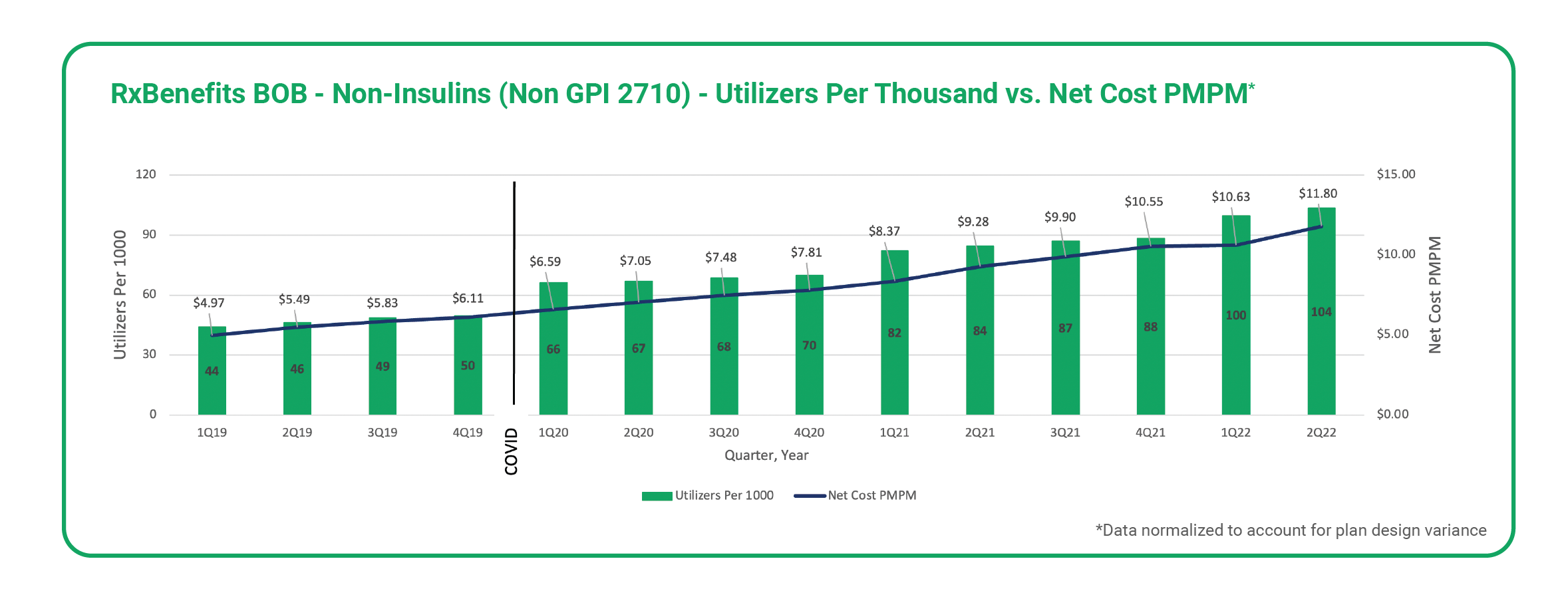

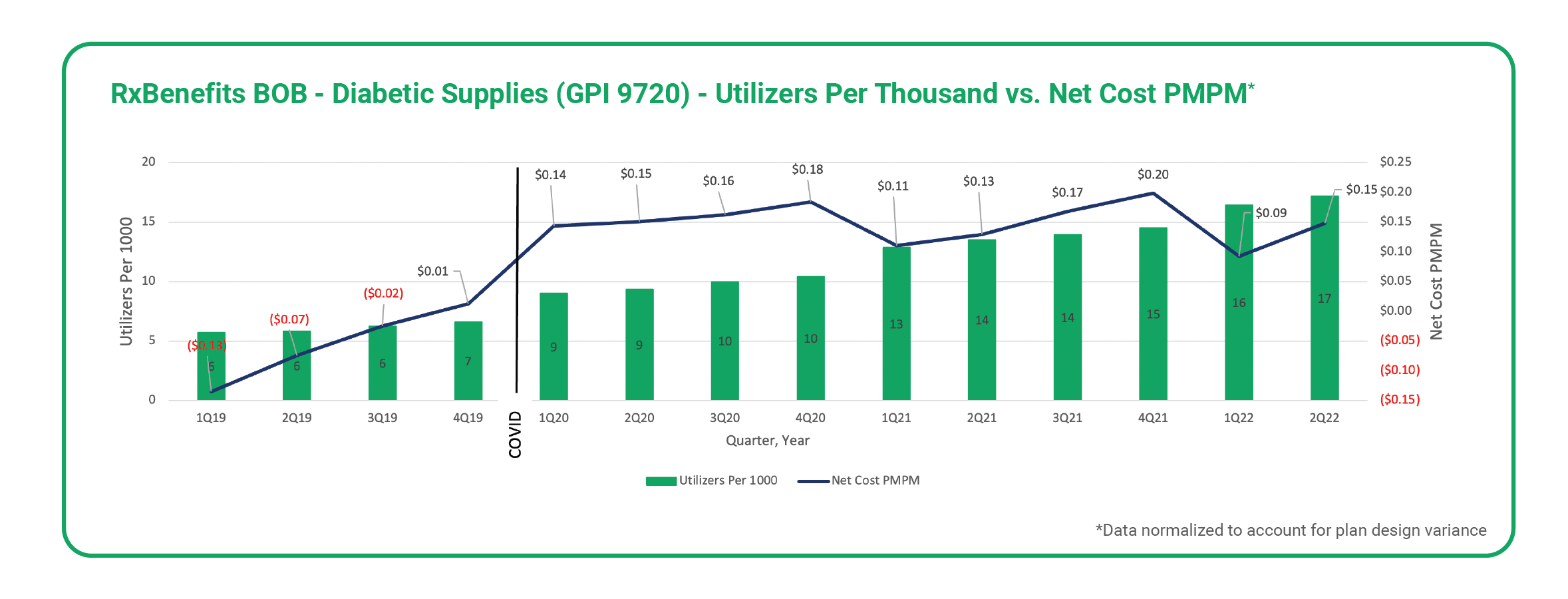

However, when factoring in the gross-to net impact of rebates associated with RxBenefits contracts, net costs of insulin and supplies on an adjusted PMPM basis remain relatively stable, while the majority of net cost increases are focused on non-insulin, non- diabetic supply-related conditions (See Figures 1-4).

Figure 1 indicates an almost 75% increase in net costs from Q1-2019 to Q1-2022 coupled with an almost 125% increase in diabetic medication/supply utilizers on a per 1,000-life adjusted basis.

Figure 2 indicates an approximately 11% increase in net costs from Q1-2019 to Q1-2022 coupled with a 100% increase in insulin utilizers on a per 1,000-life adjusted basis.

Figure 2 indicates an approximately 11% increase in net costs from Q1-2019 to Q1-2022 coupled with a 100% increase in insulin utilizers on a per 1,000-life adjusted basis.

Figure 3 indicates an approximately 114% increase in net costs from Q1-2019 to Q1-2022 coupled with an almost 127% increase in non-insulin utilizers on a per 1,000-life adjusted basis. Non-insulins are primary oral medications (e.g. Rybelsus Januvia, or Jardiance) and non-insulin injectables (e.g., Ozempic, Trulicity, or Victoza).

Figure 4 indicates large increase from Q1-2019 to Q1-2020 tied to increased utilization, coverage initiation of continuous glucose monitors (CGMs) and the removal of member cost constraints by many RxBenefits clients. However, since Q1-2020, net costs have remained relatively flat to Q1-2022 despite an over 75% increase in diabetic supply utilizers on a per 1,000-life adjusted basis.

As one can see from the above figures, the majority of utilizer increases are in the non-insulin realm. This may be due to a combination of better tolerated, new diabetic medications combined with increased marketing for the newer, more expensive brand agents. For example, in 2021, four of the top 10 highest ad spend medications were diabetic treatments (Rybelsus [2], Ozempic [5], Trulicity [6], Jardiance [7]) which accounted for $242.3M in ad spend.6 One may conjecture that when lacking things to do and consuming television, advertising medications that may control your diabetes and help you lose a little weight may be appealing to a population under duress.

A ticking time bomb of chronic conditions?

While there may be an association between COVID-19 and diabetes, the jury is still out on whether COVID is the cause of this increase; however, the relationship between COVID and long-term chronic conditions shows this will be a long-term problem. Healthcare costs increase exponentially when the number of chronic conditions increases. Members with one to two chronic conditions increase plan spend by 2.8 times more than members with no chronic conditions. At three to four chronic conditions, the plan spend increases by 5.4 times per member.5

The lingering impact of COVID-19 can feel exhausting, and as restrictions continue to lift, it’s tempting to tune out the latest news on the pandemic. But benefits advisors, plan sponsors, and researchers across the medical field cannot turn their backs on this potential ticking time bomb of chronic conditions. Only time will tell whether or not this increase will level off into a predictable pattern.

“It’s simply too early to say why we’re seeing the trends we’re seeing between COVID-19 and diabetes,” critical care physician Abhijit Duggal told the Cleveland Clinic.

And it’s simply too early to stop paying attention to the ramifications of COVID-19.

Sources:

- RxBenefits Book of Business January, 2019 – August, 2022

- https://www.cidrap.umn.edu/news-perspective/2022/08/new-type-2-diabetes-diagnoses-youth-climbed-77-amid-covid-19

- https://www.heart.org/en/news/2022/09/19/blood-clot-risk-remains-elevated-nearly-a-year-after-covid-19

- https://www.newsobserver.com/news/coronavirus/article266179606.html

- https://www.rand.org/content/dam/rand/pubs/tools/TL200/TL221/RAND_TL221.pdf

- https://www.fiercepharma.com/marketing/goodbye-humira-hello-dupixent-sanofi-and-regeneron-outspend-abbvie-to-take-2021-s-top-0