Specialty medications — high-cost drugs that treat complex, chronic, or rare conditions — continue to be the primary drivers of drug spending for pharmacy benefit plan sponsors. These treatments may require special handling, close oversight, or supervision from a specialist health care provider, and benefit advisors who work directly with employers listed specialty drug spending as one of the top trends of 2022 during our Top 5 Pharmacy Benefits Takeaways of 2022 webinar.

Download our Benefit Advisor’s Guide to 2023 eBook

Growing financial pressure from these expensive medications has led to increased interest in patient assistance programs of all varieties. But finding the right solution requires truly understanding the specialty drug trend, reviewing the RxBenefits book of business with our pharmacy benefit experts revealed the impact of rebates, discounts, and manufacturer copay assistance on specialty drug spending.

What are the largest drivers of spending for specialty medications?

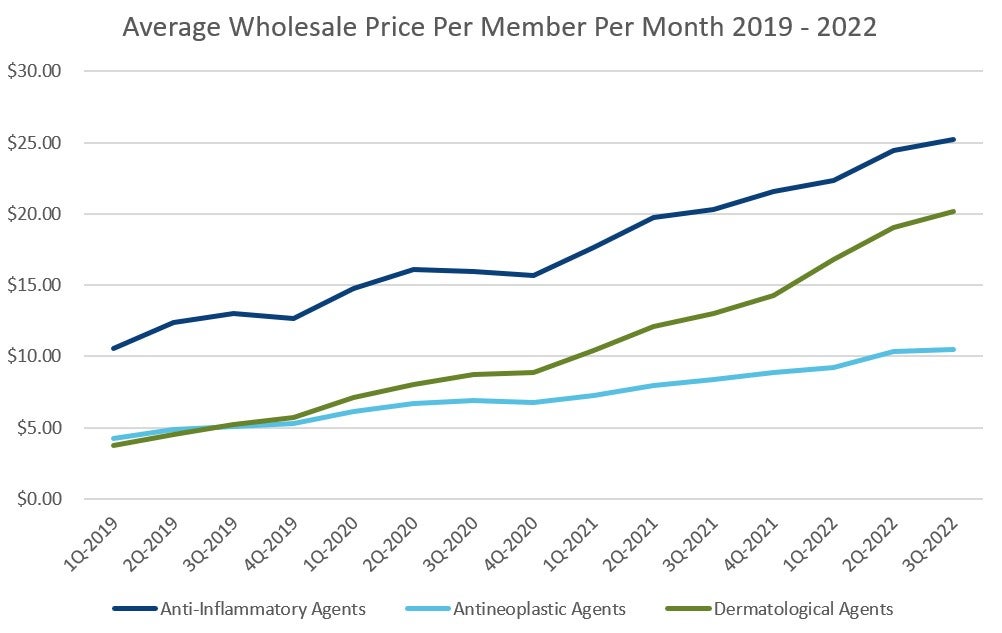

To get a perspective on what’s driving specialty costs today and what mitigation tools are effective, RxBenefits data and clinical experts analyzed the data on average wholesale price PMPM, gross cost PMPM, gross minus rebates, and plan cost minus rebate our clients have been seeing over the past year.

When looking for the largest drivers of spending for specialty medications, three drug classes show up: anti-inflammatory, dermatological, and oncology. With dermatological drugs, such as Skyrizi and Rinvoq, growth in utilization correlates with growing direct-to-consumer advertising. These ads drive demand for new prescriptions, and while they may be the right fit for some patients, RxBenefits clients with Protect have found that about 30% of patients need to be redirected to alternative therapy. And for many of those patients, they can increase employer costs anywhere from $30K to $60K per year per patient after rebates, discounts, and manufacturer copay assistance programs are considered. Approving those medications inappropriately could have an extraordinary burden on the employer.

Shifting or expanding the use of an existing drug to other uses is another demand driver benefit advisors need to watch. Anti-inflammatory and dermatological drugs are expanding to treat other conditions. For patients with psoriasis, their specialty medication may overlap to treat their Crohn’s disease or ulcerative colitis as well. This label expansion can increase demand.

For oncology medications, increased use can be tied to our aging population and more therapies becoming available. For all three of these medication categories, new utilization is a driver, and it’s more important now than ever to make sure the patient is on the right drug.

What flattens the cost curve for specialty medications?

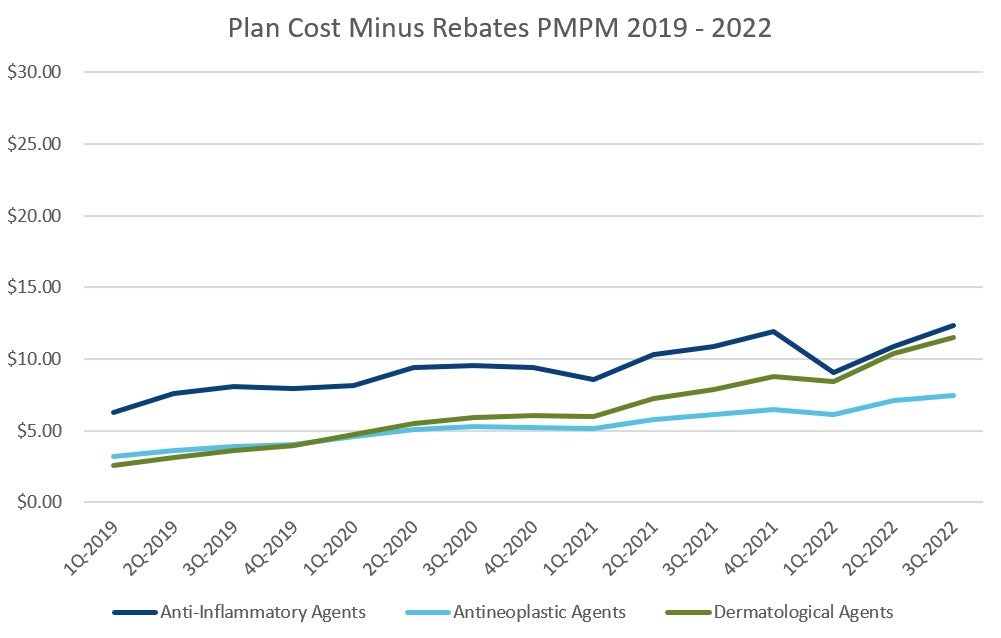

When an expensive specialty medication is the right treatment for the patient, contract levers can be pulled to drive down the price tag. Discounts, rebates, and manufacturer copay assistance programs have a direct impact on the actual cost for plan sponsors, and they’re all important aspects to consider when evaluating a potential specialty carve-out or alternative funding solution.

Pharmacy benefit managers can negotiate drug cost discounts from manufacturers, and they are typically tied to using preferred pharmacies. Discounts drive down the price tag for dermatologic and anti-inflammatory medications, but their impact on oncology drugs can be limited because some state laws prohibit pharmacy benefit managers from steering (requiring patients to use specific preferred pharmacies rather than the pharmacy of the patient’s choice).

Rebates for anti-inflammatory and dermatologic medications make these drugs more affordable, but some oncology drugs are only available through limited distribution and may not have rebates available. Manufacturer copay assistance programs can also drive down the final costs for all three of these specialty medication drug classes. In the RxBenefits Book of Business, we see that these tactics take the cost per member per month for anti-inflammatories from $25 to $12, cutting the impact on the plan sponsor in half.

Look at all sides of the equation before moving to specialty carve out

Making sure a client has the best contract value, installing manufacturer copay assistance programs, and negotiating aggressive rebates help buffer the specialty medication impact for clients. These make specialty drugs more affordable, but rebates, copay assistance, and discounts can be lost with specialty carve out programs. These missing pieces of the equation are replaced with fees. To make up for the increased cost, employers need to convert 60% or more of their specialty spend to patient assistance before there’s a substantial value from the move to a patient assistance provider. Working with a team of experts to evaluate each plan’s impact from specialty is key to making the right choice for your clients.