Questions You Should Ask to Assess The Robustness Of Your Medical Benefit Specialty Drug Management Program – Part 1

This is part one of two-part series on specialty drug management and spend.

Advances in the understanding of the human genome, medical science, and pharmaceutical research innovation has led to:

- Doubling of the hepatitis C cure rate to greater than 90% in less than half the time via oral therapy1

- Quadrupling response duration from 6 to 24 months in select patients with metastatic non-small cell lung cancer with combination oncology immunotherapy infusions of Opdivo® (nivolumab) and Yervoy® (ipilimumab) compared to standard therapy2

- Hope for retaining and restoring some vision via a one-time gene therapy injection in each eye with Luxturna® (voretigene neparvovec-rzyl) for individuals with a rare congenital retinal degenerative disorder

- A gene therapy treatment option for infants and toddlers with spinal muscular atrophy (SMA), which, if left untreated, generally leads to death prior to 2 years of age. This treatment, Zolgensma® (onasemnogene abeparvovec-xioi), requires just one infusion.

These breakthrough medications are considered “specialty drugs.” Specialty drugs are high-cost medications used to treat complex, chronic, or rare conditions. The medications may require special handling and close oversight and supervision by specialist health care providers. Specialty drugs may be covered under the pharmacy benefit, as is the case for the hepatitis C therapies, or the medical benefit, as is often the case for Opdivo®, Yervoy®, Luxturna® and Zolgensma®.

With medical advancements come high costs:

The average cost of an 8-week course to treat hepatitis C is $34,000, with some hepatitis C cases requiring 12 weeks of therapy increasing annual cost for combination Opdivo® and Yervoy® therapy is in excess of $150,000 and Luxturna® therapy cost exceeds $850,000. The cost for a Zolgensma® infusion is a record-breaking $2.1 million. The drug pipeline is full of specialty drugs with the potential to provide hope for cures for those who previously had none.

Globally, specialty drugs are expected to represent nearly two-thirds of newly launched medicines over the 5 years spanning 2019 – 2023, with oncology products representing 30% of newly launched medicines.3(p15) It is expected that the median annual price for newly launched oncology products in the United States will be well above $100,000 by 2023.3(p10)

You worked hard to implement programs under your pharmacy benefit to manage the cost of specialty drugs:

- you instituted formulary management with preferred products, prior authorization, and step therapy;

- deployed exclusive specialty pharmacy distribution channel arrangements with known product discounts and high-touch, disease-focused patient care programs; and

- leveraged pharmaceutical company assistance programs via copayment maximizers and obtained specialty drug rebates.

Your plan is in place, and you feel confident that you have covered all the bases to address rising specialty drug spend. But have you? Specialty drugs may be covered under the pharmacy benefit or the medical benefit. In fact, up to 50% of specialty drug spend may be through your medical benefit.

Moving medical benefit specialty drugs to the pharmacy benefit may reduce drug spend but is not a viable solution for all such drugs and may result in reduced care efficiencies. Therefore, before making changes in benefit coverage, it is important to understand the controls your medical carrier has in place to manage the cost of specialty drugs under the medical benefit.

What questions should you ask to assess the robustness of your medical benefit specialty drug management program?

Key differences between pharmacy benefit and medical benefit drug claims

Pharmacy Benefit Claims

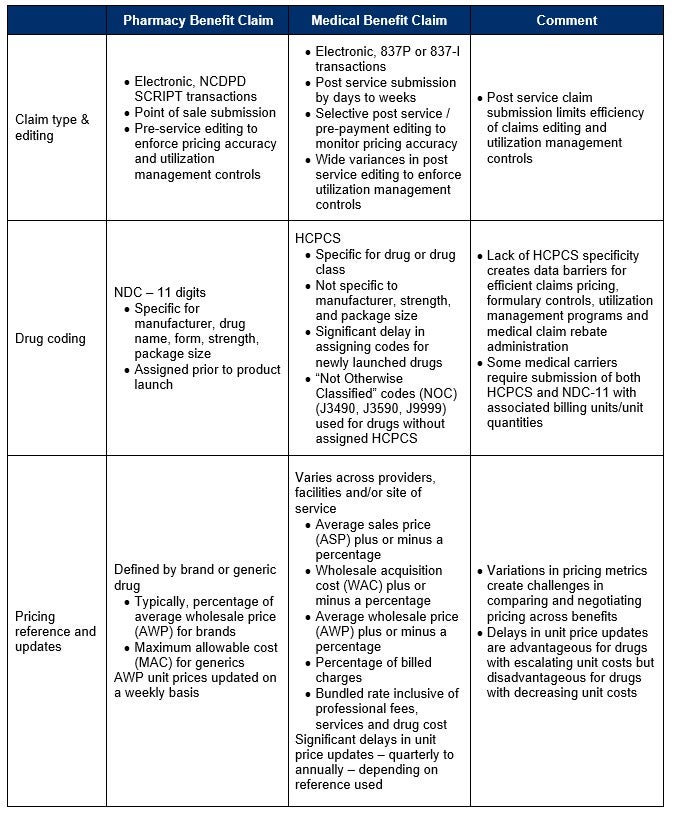

There are material differences in how medications are processed and billed under the pharmacy and medical benefits that influence the approach and efficiency to managing specialty drugs under each benefit (Table 1). For example, pharmacy benefit claims use consistent, standard processes for drug identification via the 11-digit National Drug Code (NDC-11). They are processed in real-time with pre-service (prior to dispensing) editing to enforce pricing accuracy at the specific pharmacy-negotiated discount and patient cost share/deductible status.

Specialty pharmacy fee schedules are negotiated as part of the pharmacy benefit management contract and defined at the drug and specific specialty pharmacy level. The rates are typically negotiated as a percentage of average wholesale price (AWP) for brand drugs or a maximum allowable cost (MAC) for generic drugs. Drug reference pricing databases are updated on a weekly basis to assure AWP unit costs reflect the current market rates.

Medical Benefit Claims

Medical benefit claims, on the other hand, are typically submitted electronically days to weeks after the drug was administered to the patient. Depending on your medical carrier, post service editing to assure pricing accuracy may be used only selectively depending on claim cost. There are also wide variances in how medical carriers enforce claim-based utilization management controls. The Healthcare Common Procedure Coding System (HCPCS) is used to identify medications billed under the medical benefit.

Unlike the NDC-11, HCPCS codes are not specific to manufacturer, strength, or package size. It takes months to years for newly launched products to receive a unique drug class-specific HCPCS code. Until unique codes are assigned, products are grouped under the “not otherwise classified” codes (NOC) of J3490, J3590, and J9999. This lack of HCPCS specificity creates data barriers for efficient claims pricing, formulary controls, utilization management programs, and medical claim rebate administration.

To address this, government programs such as Medicare and Medicaid require physicians and facilities to submit HCPCS, NDC-11, and associated billing units/unit quantities on medical claims for drugs. Taking the cue from Medicare and Medicaid, some medical carriers require the same for their commercial plans.

The Differences

Unlike the pharmacy benefit, where there is uniformity in the drug pricing reference (AWP) and updates, medical plans typically do not have a uniform drug pricing reference for drugs across all providers, facilities, and other sites of services. Contract rates for medical benefit drug costs may be based on:

- a markup or discount off the average sales price (ASP) published by CMS,

- markup or discount off the wholesale acquisition cost (WAC),

- markup or discount off AWP, a percent of “billed charges” in which the provider or facility establishes their own drug reference price; or

- a bundled rate that combines medical services and the cost of the specialty drug.

This wide variation in drug reference pricing is one of the factors that motivated the development of the site of care programs under the medical benefit. Instead of standardizing drug pricing references and negotiating medical benefit drug costs across providers and facilities, medical benefit prior authorization programs evaluate both the clinical appropriateness of the specialty drug and the most cost-effective site of care.

One survey reported an average savings of 23% for site of care programs focused on moving services away from hospital outpatient facilities (typically the highest cost site of care) to home infusion, ambulatory infusions suites, or independent physician offices.4

Table 1: Differences in pharmacy and medical benefit drug claim submission, editing, coding, and pricing

Source: Confidio

NCPDP = National Council for Prescription Drug Programs

NDC = National Drug Code

HCPCS = Healthcare Common Procedure Coding System

What’s Next?

Understanding the differences between pharmacy and medical benefit drug claims is the first step in assessing if your specialty drug management program only addresses half of your specialty spend. In our next blog, we will present 10 questions that you can ask yourself that will be key in understanding the robustness of your specialty drug management program.

Reference List

- What is Hepatitis C – FAQ. Centers for Disease Control and Prevention. https://www.cdc.gov/hepatitis/hcv/cfaq.htm. Published July 28, 2020. Accessed December 6, 2020.

- Center for Drug Evaluation and Research. FDA approves nivolumab plus ipilimumab for first-line mNSCLC (PD-L1 tu. U.S. Food and Drug Administration. https://www.fda.gov/drugs/drug-approvals-and-databases/fda-approves-nivolumab-plus-ipilimumab-first-line-mnsclc-pd-l1-tumor-expression-1. Accessed December 6, 2020.

- The Global Use of Medicine in 2019 and Outlook to 2023. IQVIA. https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicine-in-2019-and-outlook-to-2023. Published January 2019. Accessed December 6, 2020.

- Medical Pharmacy Trend Report. Magellan Rx Management. https://www1.magellanrx.com/documents/2020/03/mrx-medical-pharmacy-trend-report-2019.pdf/. Published 2019. Accessed December 6, 2020.