Top 3 Things You’ll Learn

- 9 Humira biosimilars launched in 2023, and 2 of them are interchangeable.

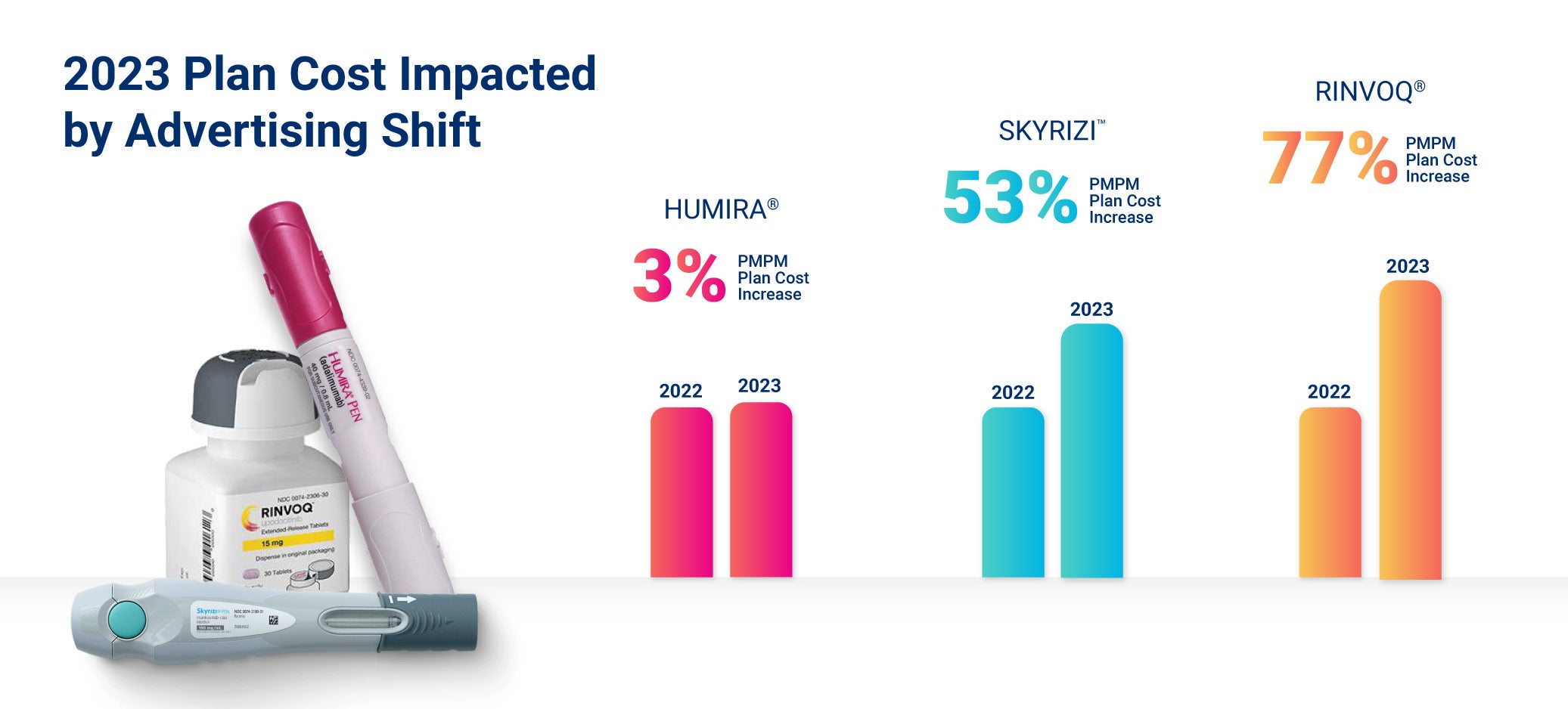

- Plan costs for Skyrizi and Rinvoq grew faster than biosimilar claims for Humira in 2023.

- 12 blockbuster biologics have biosimilars in the pipeline.

With nine competitors launching in one year, Humira and its biosimilars held the pharmacy world’s focus in 2023. Biosimilars have been available in the U.S. for nearly a decade, but the impact of these new drugs has been mixed. While there’s a reasonable increase in use of oncology biosimilars (anywhere from 50 – 80% of market share), there’s low adoption of other biosimilars like insulin (3%).

With more biologics mimicking blockbuster reference drugs like Humira in the pipeline and increased scrutiny on drug pricing, benefit advisors need to know the latest developments to advise their clients.

What Happened with Humira Biosimilars in 2023?

All eyes were on anti-inflammatory biosimilars in 2023 as multiple biosimilars for Humira entered the market, but there are four notable hurdles to the broader acceptance of these new drugs.

- Adoption has been slow, but new formulary developments may increase patient usage. The nine new biosimilars for Humira include two that have interchangeable status. Pharmacists can easily swap prescriptions for approved uses when a biosimilar is interchangeable with its originator biologic. However, the other seven biosimilars for Humira require a new prescription to be written, and dermatologists haven’t fully accepted these new treatments as options for their patients. In January 2024, CVS announced it would remove Humira from most of its commercial formularies and replace it with biosimilars in April 2024. CVS predicts the change will save up to 27% in net cost this year.

- Humira has many approved indications after 20 years of research and development and patent extensions. However, biosimilars can only be used for FDA-approved indications, meaning that these biosimilars are not applicable for all diagnoses and dose forms available to Humira.

- Pricing strategies impact plan costs: Several of the new Humira biosimilars have two listed price points — a high and a low, with different levels of rebates. This has impacted formulary placements, and which products will have the lowest net cost for plans will vary.

- AbbVie changed its marketing strategy to avoid losing market share: The manufacturer of Humira, AbbVie, lost about 35% of patients to biosimilars in Europe, but in the RxBenefits 2023 Book of Business, we see a different pattern emerging in the U.S. AbbVie prepared for the launch of biosimilar competitors by shifting marketing focus from Humira to other anti-inflammatory drugs like Rinvoq and Skyrizi, which led to a coinciding increase in the utilization of both drugs in the average per member per month (PMPM) plan costs.

Benefit advisors should keep an eye on the contract language and the true lowest net cost when helping their clients navigate this landscape, and that includes watching the biosimilar pipeline.

What Are the Top Biosimilars to Watch in 2024?

Multiple biosimilar drugs are in the pipeline, targeting biologic reference drugs ranging from Actemra to Stelara. Benefit advisors should look for these drugs in their clients’ utilization reports for potential upcoming plan impact.

| Biologic Reference Drug | Indication | Timeline |

| Stelara | Plaque psoriasis, psoriatic arthritis, Crohn’s disease, ulcerative colitis | One interchangeable biosimilar, Wezlana, was approved in 2023. |

| Actemra | Rheumatoid arthritis, giant cell arteritis, cytokine release syndrome, COVID-19 | Tofidence approved in 2023. |

| Cosentyx | Moderate to severe hidradenitis suppurativa, plaque psoriasis, psoriatic arthritis, ankylosing spondylitis | Biosimilar in Phase 3 trials. |

| Enbrel | Rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, plaque psoriasis | Two biosimilars, Eticovo and Erelzi, are approved and expected for release in 2029. |

| Simponi | Rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, ulcerative colitis | Loses exclusivity in 2024. Biosimilars in development, with one in Phase 3 trials. |

| Cimzia | Crohn’s disease, rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, plaque psoriasis | Loses exclusivity in 2024. Biosimilars in development. |

| Soliris | Atypical hemolytic uremic syndrome, myasthenia gravis, neuromyelitis optica spectrum disorder, paroxysmal nocturnal hemoglobinuria | Phase 3 trials complete for biosimilar, but launch delayed until 2025. |

| Xolair | Moderate to severe asthma | Biosimilars in development. |

| Tysabri | Multiple sclerosis | Tyruko was approved in 2023 and is expected to launch in the first half of 2024. |

| Eylea | Ophthalmological therapy, age-related macular degeneration, diabetic macular edema, diabetic retinopathy | Biosimilars in development. |

What Will It Take for Biosimilars to Make a Difference in Plan Spend?

Adoption of biosimilars remains relatively low for the important specialty drug category of anti-inflammatory treatments. Many of the anti-inflammatory medications coming off patent have multiple indications and are embraced by healthcare providers.

Healthcare providers haven’t fully adopted biosimilars, and until they do, it is unlikely these drugs will be prescribed directly. Prescribers are familiar with biosimilars, but they have efficacy concerns. Many are waiting to see a price difference of 20 to 30% to be motivated for a change.

In 2024, legislation may impact high-discount biosimilars in Medicare Part D requiring biosimilars be priced at least 45% lower than reference biologics. This rule wouldn’t directly impact your commercial clients but may indirectly impact biosimilar pricing and formulary strategies.

Formulary placements may provide a tipping point for biosimilars in 2024. As our experts noted last year, Mark Cuban Cost Plus Drug Company priced Humira biosimilar Yusimry competitively. The pressure on pharmacy benefits managers to lower drug prices is growing, and the latest CVS formulary announcement may just be the beginning of a new wave for biosimilars.