Top 3 Things You’ll Learn

- Florida unanimously passed sweeping PBM legislation.

- Multiple states aim to regulate ERISA plans.

- Nearly all states have PBM legislation on the books.

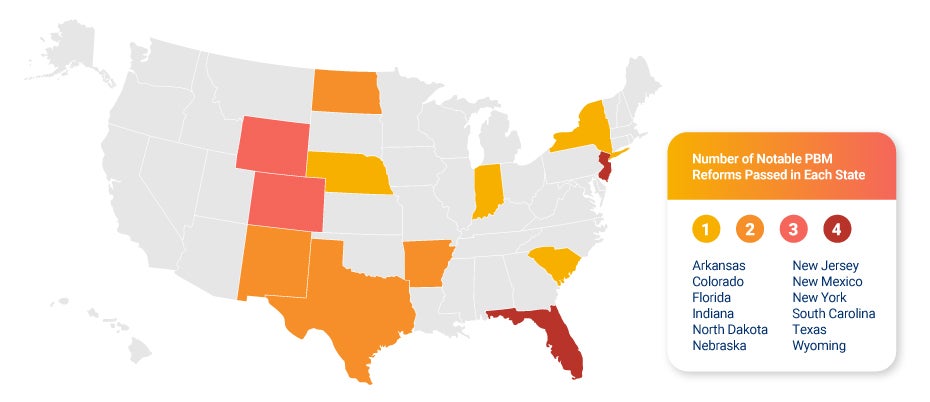

This year, more than 500 state laws aiming to regulate PBMs caught our legal team’s eye. This massive list doesn’t include the hundreds upon hundreds of other bills introduced nationwide in 2023. Though hundreds were introduced, less than 20% of the bills we tracked passed this year.

The bills that did pass had a significant impact. All benefit advisors need to know these five pharmacy benefit state legislative trends heading into 2024.

#1 Transparency is the watchword this year.

Transparency is the overall theme of PBM reform this year at the state and federal level. Policymakers have zeroed in on rebates as a potential issue in the supply chain that may cause drug prices to be inflated, and concerns about PBMs favoring high-cost, high-rebate drugs on the formulary have driven rebate regulations. On the other hand, PBMs argue that rebates flow through to the plan sponsor to achieve the lowest net cost for the drug.

In New Mexico, Indiana, New Jersey, Wyoming, Florida, and Arkansas, new bills will require PBMs and insurers to pass through rebate dollars to the plan, and in some cases, use drug rebates to reduce the cost of the drug at the register. The aim is to reduce member cost share, and any leftover rebate dollars would be passed through to the plan to reduce members’ premiums further. A similar law already existed in West Virginia.

#2 Florida throws the kitchen sink at PBMs.

The most significant bill of the year, without question, was Florida’s Prescription Drug Reform Act. The new law is nearly 50 pages long, and it passed unanimously. The legislation includes several PBM restrictions, including anti-steering language, prohibiting PBMs from using a spread pricing model, and a requirement that PBMs pass through 100% of manufacturer rebates to clients. The law, which will impact prescription drug plans beginning January 1, 2024, requires the plan to use rebates to offset cost sharing and premiums. The PBM is accountable for passing through the rebate, while the plan is accountable for reducing the expenses of individual plan members. Florida’s sweeping reforms target all plans domiciled in the state, but not all PBMs agree on the scope of the new law. Benefits advisors should consult their pharmacy benefits vendors and legal counsel to determine if action is needed for their clients.

#3 Classic PBM restrictions continue to gain state attention.

This year, multiple states, including Colorado, New York, and Texas, restricted copay accumulators. A copay accumulator prevents manufacturer copay cards or coupons from being counted toward a member’s out-of-pocket cost maximum. When these programs are banned, all payments the member makes — whether directly, or indirectly using a card or coupon — will count toward their out-of-pocket maximum. This has also become a federal issue with a recent court ruling.

Other states, including North Dakota, South Carolina, and Wyoming, passed anti-steering bills. While every state’s anti-steering law is unique, these rules aim to prevent the PBM from steering plan members to use the PBMs’ owned or affiliated pharmacies. However, a few states made exemptions for specialty drugs with unique distribution needs and higher price tags. Deep discounts from PBM-owned specialty pharmacies can significantly impact the cost of these specialty medications. Nearly 50% of states now have anti-steering regulations.

#4 Gold-carding shines a light on utilization management.

States are showing an increased interest in regulating traditional utilization management techniques, such as prior authorizations, step therapy, and quantity limits. Of the 500-plus bills tracked by our team this year, 160 touched on utilization management.

This year, Arkansas passed HB1271, which will introduce “gold carding” for insured and self-funded plans in the state. With this type of system, if a provider has a high enough approval rating on prior authorizations for a certain period, they’re given a gold card status that ensures their prescriptions get automatic approval. Gold carding regulations exist in Texas and West Virginia but only apply to the insured market. A similar law in Michigan is also on the books.

These laws may introduce efficiencies, but automation like this removes the perspective of clinical experts who know an individual plan’s goals and FDA guidelines. Without independent clinical oversight, these automatic approvals could unintentionally increase plan costs or off-label prescribing that may put a patient in danger.

#5 New York tests proposed rules for both ERISA and non-ERISA plans

In 2022, New York passed a comprehensive PBM bill, and the state’s Department of Financial Services released the proposed rules this fall. The proposed rules were sweeping, creating a regulation like no other. It included bans on spread pricing and steering and also mandates NADAC pricing plus a dispensing fee that would add more than $10 per prescription filled in the state. The provisions aimed to regulate self-funded ERISA plans, which are typically exempt from state law, and would’ve placed the strictest regulations in the country onto PBMs. After pushback from multiple interest groups in New York, DFS withdrew the proposed rules. However, DFS may well come back with a new proposal in the future, so New York remains one to watch as we enter 2024.

Learn about the recent court decision regarding Oklahoma’s PBM regulations.

As another busy season of PBM regulation comes to an end, it’s clear that PBMs are top of mind for state regulators. Consumer advocacy and pharmacist groups point to PBMs as the cause behind high drug prices, and at the state and federal level, there’s a desire to drive those costs down. As state rules target ERISA plans, benefit advisors must keep up with more and more regulations that may apply to their clients, with nearly all states now having strong PBM legislation on the books.