Keeping Pace with This Year’s Pharmacy Benefit Developments

From new Humira® biosimilars to the meteoric rise of GLP-1s, 2023’s been a busy year for the pharmacy benefits industry. With many economic experts predicting a recession, self-funded carved-out plan sponsors need solutions to keep their pharmacy benefits affordable, while taking great care of their members.

As the bulk of plan sponsors get closer to deciding on their benefits structure for 2024, benefit advisors need to stay informed about the latest developments in the industry to make the best recommendations. With this eBook, you’ll learn about what’s impacting clients nationwide.

Questions we’ll cover:

- How will the launch of Humira® biosimilars impact 2024 plans?

- What are the latest trends in diabetes drugs and off-label use?

- Will ongoing scrutiny of patient assistance solutions and manufacturer copay assistance programs impact the dollars available to plan sponsors?

- What’s the latest on federal investigations on PBMs?

The challenges of high-cost claims keep plan sponsors up at night, and as their trusted benefit advisor, you can help them create a sustainable solution that addresses the problems of 2023, 2024, and the years beyond.

Plan Sponsors Struggle with GLP-1 Off-Label Prescription Claims

As a drug class, glucagon-like peptide 1 (GLP-1) agonists have been around since 2005. These FDA-approved medications were developed to treat Type 2 diabetes by managing appetite, insulin, and glucagon levels, but recently, drugs in this category, such as Ozempic®, Mounjaro™, and Victoza®, have exploded in popularity because of their impact on weight loss.

This growing demand, driven by social media, celebrity endorsements, telehealth platforms, and direct-to-consumer advertising, has led to drug shortages, rising plan costs, and increased off-label prescribing.1,2 Since going viral, these diabetes treatments are flying off the shelves as people flock to physicians looking for off-label prescriptions to achieve fast weight-loss results.

These injectable Type 2 diabetes medications can have a gross cost price tag of $750 to almost $1,000 for a 30-day supply — just under the price threshold that flags a medication for a traditional prior authorization. When it comes to covering off-label drug use for weight loss, plan sponsors face a growing expensive trend, with RxBenefits’ Book of Business showing a 40% increase year-over-year for this category.

Ozempic® alone represented 4% to 5% of total plan cost for the average client in the RxBenefits’ Book of Business in Q1 of 2023.3 A single group saw their costs go from $4 per member per month in 2021 to $18 PMPM in 2023.

Many of these medications have similar products that are indicated for weight loss, such as Saxenda® and Wegovy®, but most employers choose not to cover weight-loss drugs.

Plans that cover these medications typically require prior authorization before the prescription is filled.4 If an employer wants to limit their exposure to off-label use of these drugs, they need proper utilization management programs in place to ensure the medications are being used for an FDA-approved

indication. Utilization management reviews should include detailed medical chart notes to confirm medical necessity and FDA-approved dosing.

New this year, RxBenefits added a smart prior authorization for GLP-1s, allowing clients to verify that patients using these drugs have a confirmed diabetes diagnosis before filling the prescription.

About 15% of total RxBenefit prior authorizations have been related to GLP-1s this year, and less than half of those prescriptions were based on a diagnosis of diabetes.

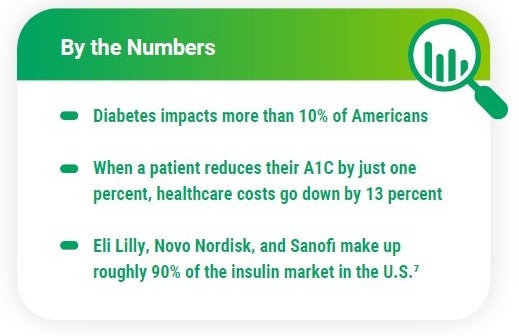

Manufacturers Adjust Insulin Prices After Inflation Reduction Act

Over the last two decades, insulin prices have more than tripled.5 In January, the Inflation Reduction Act capped monthly out-of-pocket insulin costs at $35 for Medicare beneficiaries. The bill didn’t impact commercial plans, but with it came increased pressure for drug manufacturers to reduce the cost of insulin for all diabetes patients.

Insulin products have a significant impact on overall plan costs – more than 8 million Americans use insulin to control their diabetes. In the RxBenefits’ Book of Business, diabetes treatments account for 18% of the total gross cost for pharmacy plans.3

Three of the top insulin manufacturers announced lower insulin prices shortly after the Inflation Reduction Act went into effect. Starting in January 2024, prices for certain insulin products from Eli Lilly, Novo Nordisk, and Sanofi will be drastically reduced. The change will likely benefit manufacturers as they will avoid owing the federal government hundreds of millions of rebates dollars next year.6

The pricing change will help members on high-deductible health plans, but members on other types of plan designs may not see an impact on their out-of-pocket expenses. It’s important to remember that insulin is seen as the last resort for patients with Type 2 diabetes, and many other drugs and supplies will continue to drive costs for this category.

Building an Understanding of Biosimilars Will Help You Navigate the Year Ahead

What is a biologic?

Biologic therapies are large-molecule specialty medications made from living cells. There are more than 350 biologics on the market, including Humira®.

What’s a biosimilar?

A biosimilar is a biologic that closely mimics an existing, approved biologic known as the reference product. These drugs must show no clinically meaningful difference in safety, purity, and potency from the reference product.

What does it mean when a biosimilar has interchangeable status?

When a biosimilar achieves an interchangeable designation from the FDA, it may be substituted for the reference product without the involvement of the prescriber. Non-interchangeable products require a new prescription written specifically for that biosimilar.

Employers Will Likely Benefit from Race to the Bottom for Humira® Biosimilars

Specialty medication spend continues to grow for plan sponsors — particularly, anti-inflammatory and dermatological agents represented about 27% of the gross cost for plan sponsors in our Book of Business in 2022.3

This year, multiple biosimilars have come to market for Humira®, one of the most popular drugs in these categories. The launch of these biosimilars will be impactful, but the question is, how soon will we see the impact?

At least 11 biosimilars are expected to come to market in 2023, with a majority launched in July. In June, Coherus BioSciences announced that its Humira® biosimilar Yusimry™ would launch with a price point 85% lower than the originator, and a PBM partnering with Cost Plus Drugs will offer it online for $570 plus fees.8,9

Pharmacy benefit managers have begun to update their formularies to account for these new drugs.10 The landscape for these biosimilars is evolving quickly, and a race to the bottom for pricing of biosimilars and their originator will ultimately drive lower costs. This will impact Humira® prescriptions and other popular brands in the anti-inflammatory and dermatologic categories with biosimilars launching in the next few years.

The biosimilars on the market today must be FDA approved and be deemed safe and effective. Only one biosimilar, Cyltezo™, launched with interchangeable status, but there are at least five others seeking that status. The result of these products hitting the market will be substantially lower net cost. And when that happens, the employer benefits.

While it may be tempting to explore switching for a discount on one drug, there’s a chance this could impact the plan’s overall contracted pricing and not lead to the desired savings a client needs.

Humira® is a highly rebated product, and those rebates are passed down to plan sponsors. Whereas Yusimry™ will have a lower net cost without a rebate, the loss of rebates for Humira® may impact the overall value of the pharmacy benefit. Some employers may want to offer individual members the lowest net cost for their drugs, while others may rely upon these rebates to fund other elements of their benefits package or keep the pharmacy benefit costs low for all members.

Enhancements to Protect in 2024 will add a High-Touch Therapeutic Interchange to identify members who take anti-inflammatory medications and dermatologic agents and would benefit from strategic clinical intervention. This program will ensure these members are on the most appropriate, optimal treatment available.

Legal Action Against Patient Assistance Vendor Seen as Warning Shot From Pharma

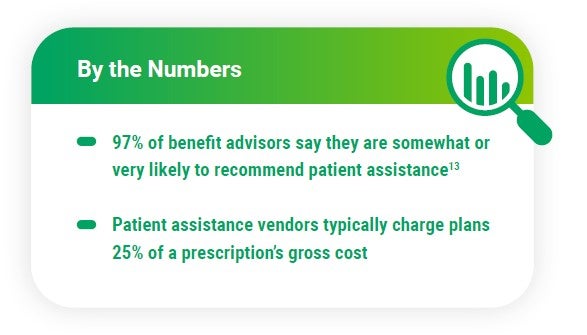

Many employers and benefits advisors turn to patient assistance solutions to help combat the high cost of specialty drugs. A key element of carving out coverage for these costly drugs is providing members with the support they need to find alternative solutions for filling much-needed prescriptions. Patient assistance vendors provide the link between the member and the organizations that offer financial aid for their medications.

Some drug manufacturers have begun to exclude their products from these patient assistance programs, and others have begun to change qualification requirements to eliminate members whose plans have carved out these drugs. In May of 2023, AbbVie sent a warning to all patient assistance vendors by filing a lawsuit against the market leader, Payer Matrix, LLC.

The lawsuit accuses Payer Matrix of fraudulently enrolling insured patients into a charitable program that provides medications to uninsured and underinsured patients.11 The suit followed a change to AbbVie’s patient assistance program that disqualifies applications using an alternate funding program and a letter from AbbVie to Payer Matrix stating that patients working with Payer Matrix would not qualify for the assistance dollars. Payer Matrix responded publicly that the lawsuit shows AbbVie misunderstands the company’s purpose and the people they serve.12

After seeing the lawsuit news, benefit advisors began to ask: Will patient assistance programs end? In the short term, it’s unlikely these programs will go away, but their value may diminish for employers. A holistic approach to specialty drug costs will provide employers with the best defense against high-cost drugs, and that may include patient assistance where members qualify.

With our partner programs for patient assistance, RxBenefits aims to solve issues with the traditional approach to alternative funding. By focusing on clinical oversight and member experience, RxBenefits can help plan sponsors find more success compared to a solely financial approach to the problem. Keeping with our client-aligned model, RxBenefits doesn’t receive any fees or commissions for implementing these solutions — we offer them solely as a service to

our clients.

MCAP Legal Battle Could Negatively Impact Popular Money-Saving Program

Another avenue for limiting a plan’s exposure to specialty drug costs faces legal challenges this year: manufacturer copay assistance programs. Some plan designs using a manufacturer copay assistance program deem the drug getting assistance as nonessential, and the patient’s out-of-pocket obligations

are satisfied by the value of assistance dollars available from the manufacturer. This keeps manufacturer payments from counting towards the patient’s deductible and out-of-pocket maximums for the year and exempts the drug from Affordable Care Act (ACA) requirements that limit maximum out-of-pocket

spending for members. The drug costs are shifted from the plan onto the manufacturer while shielding the member from significant out-of-pocket expenses.

In January, a New Jersey federal court denied a request to dismiss the lawsuit between Johnson & Johnson (J&J) and SaveOnSP. Originally filed in 2022, the suit claims SaveOnSP defrauded J&J’s copay assistance program. J&J accuses the company of increasing patients’ copay amounts and pushing

them to enroll in the MCAP program, and the drug manufacturer is seeking monetary compensation and an injunction against SaveOnSP.14 Pharmacy experts are closely watching the legal battle for how it may impact the availability of MCAP dollars for members and plan sponsors.

Regulation of PBMs Becomes a Bipartisan Issue

The push to regulate pharmacy benefit managers gained bipartisan support over the spring. Congress called some PBM leaders to D.C. for a House Committee on Oversight and Accountability hearing in May. In the committee’s top takeaways from the hearing, Republicans and Democrats advocated for

shining a light on PBM practices and legislative solutions for reducing drug costs for members.15 Transparency and spread pricing were top of mind for lawmakers looking for answers to drug cost questions.

Also in May, the U.S. Senate Committee on Health, Education, Labor and Pensions introduced a bipartisan bill to expand federal regulation of PBMs.16 Unlike the Inflation Reduction Act, which focused on costs for Medicare recipients, this proposed legislation would apply to the commercial sector, including plans regulated under the Employee Retirement Income Security Act (ERISA). The bill focuses on making PBMs provide information on manufacturer copay assistance, wholesale acquisition costs, and rebates. It would prohibit spread pricing (a PBM practice of charging payers like Medicaid more than they pay the pharmacy for a medication and then keeping the “spread” or difference as profit) and require PBMs to give 100% of rebates and other discounts to the plan as well.

The Committee’s bill is one of at least 10 bills which target PBMs directly. The bills all touch on the same key issues, and they are likely to be consolidated before passing.

The hearing and the proposed legislation coincide with an ongoing Federal Trade Commission inquiry that began in 2022. In 2023, the FTC expanded its probe into the six largest PBMs by issuing compulsory orders to three group purchasing organizations. Zinc, Ascent, and Emisar Pharma Services are also sometimes called rebate aggregators. The FTC has yet to release results from their inquiry.17 Benefit advisors should keep a close eye on developments from this increased bipartisan scrutiny into PBM practices. So far, however, no developments would impact 2024 benefit plans.

Meet the Future Head-On with Tailored Solutions for Your Clients

It’s clear that no one solution will alleviate the problems plan sponsors face. New and innovative ways to control spend are needed by self-funded employers. Mitigating future risks and meeting each employer’s goals for their unique pharmacy plan requires multi-faceted, tailored solutions.

Finding new ways to control pharmacy spending will be key to creating solutions that survive GLP-1 off-label prescribing, legal challenges, federal reforms, and the latest drug releases. An informed approach focused on patient outcomes and finding the right drug for the right price can bring plan sponsors the savings they need without sacrificing member outcomes.

There’s only one absolute in pharmacy benefits: The landscape will continue to evolve. And at RxBenefits, we will continue to support benefit advisors and help clients solve the challenges of today and tomorrow.

Pharmacy Benefits Industry Fast Facts for 2023

Sources

- https://www.npr.org/2023/04/01/1166781510/ozempic-weight-loss-drug-big-business

- https://soundcloud.com/hcnradio/healthcare-de-jure-bradley-nelson?utm_source=www.healthcarenowradio.com&utm_campaign=wtshare&utm_medium=widget&utm_content=https%253A%252F%252Fsoundcloud.com%252Fhcnradio%252Fhealthcare-de-jure-bradley-nelson

- RxBenefits Book of Business 2022 – 2023

- https://www.fiercehealthcare.com/payers/payers-told-coordinate-coverage-response-ozempic-and-other-weight-loss-drugs-pbms

- https://www.npr.org/2023/03/14/1163354744/insulin-price-cuts-novo-nordisk-diabetes

- https://www.fiercepharma.com/pharma/impetus-behind-lilly-novo-and-sanofis-insulin-price-cuts-explained-report#:~:text=She%20cited%20one%20analysis%20predicting,boost%20earnings%20by%20%2485%20million

- https://www.nbcnews.com/health/health-news/insulin-users-respond-price-cuts-eli-lilly-novo-nordisk-sanofi-rcna75448

- https://www.forbes.com/sites/joshuacohen/2023/06/02/coherus-biosciences-and-mark-cubans-drug-company-aim-to-disrupt-humira-referenced-biosimilar-space-with-launch-of-yusimry-at-a-85-discount/?sh=7f748b034b8d

- https://www.ajmc.com/view/smithrx-to-offer-adalimumab-biosimilar-yusimry-at-90-discount-to-humira

- https://www.fiercehealthcare.com/payers/optum-adding-2-more-humira-biosimilars-its-formulary

- https://www.mmitnetwork.com/aishealth/spotlight-on-market-access/alleging-fraudulent-and-deceptive-scheme-abbvie-files-lawsuit-against-alternate-funding-company-payer-matrix/

- https://www.marketwatch.com/press-release/leading-patient-advocate-slams-abbvies-moves-to-deny-vital-drugs-to-needy-patients-2023-05-23

- RxBenefits Market Survey 2023

- https://pharmaphorum.com/news/jj-copay-lawsuit-against-drug-benefit-firm-gets-green-light

- https://oversight.house.gov/release/hearing-wrap-up-pharmacy-benefit-managers-prioritize-their-pocketbooks-over-patient-care%EF%BF%BC/

- https://www.congress.gov/bill/118th-congress/senate-bill/1339/text

- https://www.ftc.gov/news-events/news/press-releases/2023/05/ftc-deepens-inquiry-prescription-drug-middlemen

About the Authors

Wendy Barnes – Chief Executive Officer

With more than 30 years of healthcare management experience, Wendy joined RxBenefits as Chief Executive Officer in 2022 after serving as the President of Express Scripts Pharmacy where she oversaw the service, operation, and financial success of the organization’s multiple pharmacies on behalf of 100 million beneficiaries. Prior to this, she held a variety of healthcare leadership roles at Rite Aid and Premier Inc. and served as a Medical Service Corps Officer stationed around the globe.

Both a strategic leader and visionary, Wendy is driven by a desire to bend the healthcare cost curve to serve patients better. In RxBenefits’ new chapter, Wendy continues to fulfill the organization’s mission of delivering greater healthcare value to employee benefit consultants and plan sponsors.

Nathan White – Chief Client Officer

Nathan joined RxBenefits in 2017 with more than 18 years of experience in pharmacy client consulting, account management, and medication compliance and safety with both CVS Health and OptumRx. Nathan’s successful career has been fueled by his passion for helping benefit consultants and clients cut through the complexity inherent in the pharmacy ecosystem so that they can make intelligent decisions around pharmacy benefits and developing tailored solutions that meet each client’s unique needs.

Mark Campbell, PharmD – Senior Vice President, Clinical Services

Mark is an experienced healthcare executive with focus in all aspects of the pharmacy benefit management industry. He had held numerous positions in his 22-year pharmacy career, including President and CEO of Innoviant Prescription Benefits, Vice President of Prescription Solutions, and President of Health Information Designs.

Fully Optimized Pharmacy Benefits

Employee benefit consultants and self-insured employers trust RxBenefits as a partner in maximizing the plan sponsor’s pharmacy benefits budget while protecting the health and safety of their members. RxBenefits offers consultants a superior alternative to traditional PBM arrangements by providing a comprehensive, multi-faceted suite of solutions for layered protection. These solutions include market-leading purchasing power and contract expertise, independent clinical oversight to ensure the pharmacy benefit remains both affordable and accessible, and a world-class service model that provides exceptional care to benefit advisors, employers, and plan members.